Cloud computing has revolutionized business operations by providing advanced technology with ease of access for internal teams, thereby accelerating the pace of innovation. The key advantages of cloud computing include:

- Scalability: Businesses can adjust resources based on customer demands and market conditions.

- Advanced Technologies: Instant access to artificial intelligence, machine learning, and big data analytics.

- Real-Time Insights: Enables businesses to make rapid decisions based on data analysis.

- Enhanced Security: Includes regular audits, firewalls, data encryption, and intrusion detection.

- Collaboration: Facilitates seamless teamwork across different geographies.

- Agility: Allows quick deployment of new services and systems, enhancing continuous improvement and competitiveness.

However, industries such as healthcare, finance, and government face significant challenges due to strict regulatory requirements when adopting cloud technology.

It’s a high-wire act, and if they are not in compliance with local and regional entities, they risk major fines and penalties.

A one billion Euros non-compliance fine is no small number. Just ask Meta.

Cloud migration in regulated industries must balance operational agility, data security, and compliance within digital transformation initiatives. It’s a complex process that involves navigating constantly changing regulatory standards while keeping abreast with a rapidly evolving technological environment like AI.

Each step must be meticulously planned and executed to align with stringent legal, security, and privacy mandates.

The Compliance Conundrum in Regulated Industries

Compliance is a major hurdle for regulated sectors, demanding a delicate balance between leveraging cloud capabilities and adhering to legal standards. The challenge is not only to meet these requirements but to do so without stifling innovation.

- Healthcare: Must comply with HIPAA, which evolves and demands stringent data control to protect patient information, potentially resulting in fines up to $1.5 million annually.

- Finance: Subject to GDPR and SOX, which require robust encryption and detailed audit trails.

- Government: Must adhere to FISMA and FedRAMP, necessitating ongoing risk assessments and compliance checks.

Each sector must navigate these unique regulatory landscapes, ensuring that cloud solutions not only enhance efficiency but also rigorously safeguard sensitive information against evolving threats.

A Compliance-Focused Migration: Your Roadmap to Success

For regulated industries, a proactive approach towards cloud compliance is crucial. As regulations are updating faster, senior managers and IT departments need to be continually aware of new guidelines and laws.

Consider this approach plan to maintain data security and privacy in the midst these complexities:

- Perform an Audit: Regularly update compliance checks in line with new regulations like HIPAA, PCI DSS, and GDPR.

- Select the Right MSP Partner: Partner with an MSP experienced in navigating your industry’s compliance landscape.

- Build a Tailored Strategy: Develop a strategy that includes data classification, encryption standards, and incident response plans.

- Prioritize Security Measures: Implement layered security measures including identity management, intrusion detection, and regular vulnerability scanning.

- Educate Your Team: Train all employees on compliance regulations and secure data handling practices.

- Focus on Long-Term Compliance: Maintain a strategy that includes regular audits to keep up with evolving regulations.

Regulated Industries Are Moving to the Cloud

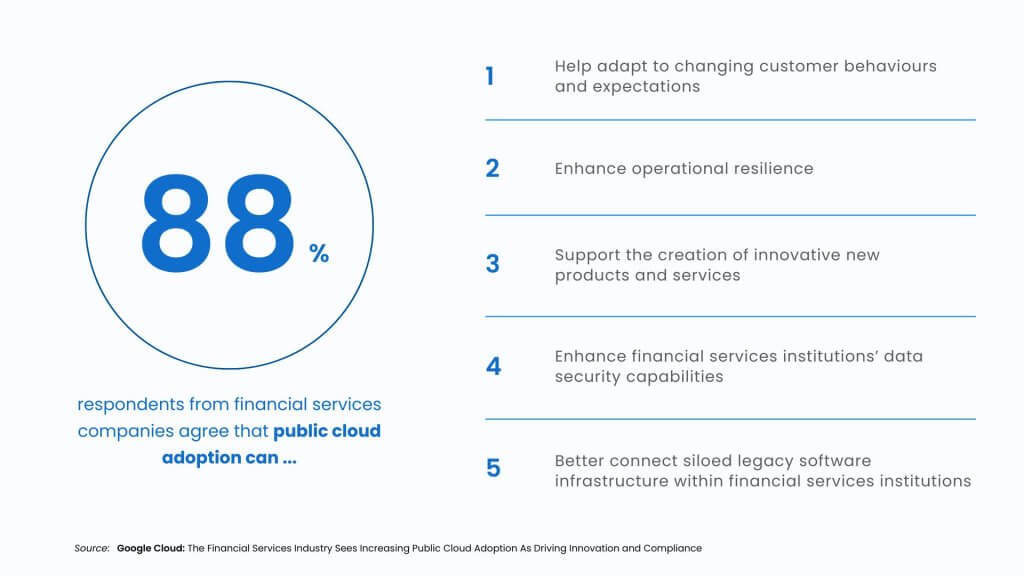

According to a Google Cloud report, 83% of financial services firms have adopted cloud technology, driven by the benefits of operational resilience, customer adaptation, and innovative capabilities.

Three Pain Points for CIOs and How to Overcome Them

- Overcoming Compliance Challenges: Leverage cloud services like AWS, Azure, and Google Cloud that offer compliance controls tailored to specific standards.

- Maintaining Data Security and Privacy: Utilize built-in security features from CSPs to enhance monitoring and reduce costs.

- Achieving Agility and Innovation: Employ containerization and serverless computing to ensure compliance while fostering innovation.

To navigate the complex regulatory landscape and harness the potential of the cloud, contact a specialized MSP like ULAP Networks. As the cloud’s potential to generate $3 trillion in value becomes increasingly evident, seizing this opportunity can significantly enhance your business’s growth and customer experience.